pay ohio unemployment taxes online

Under Account Settings on. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

Ohio Unemployment Login Problems Ohio Unemployment Ohio Gov

Report it by calling toll-free.

. Please allow 2-3 business days for the payment made to be applied to your outstanding liability. To file and pay online you can use either the ERIC system or the Ohio Business Gateway. You will be redirected to the ACI Payments Inc.

Please visit httpsthesourcejfsohiogov to enter your quarterly reports online. You can pay using a debit or credit card online by visiting ACI Payments Inc. Please review the various options employers have to submit their quarterly reports electronically.

If you have an existing PUA account you still can access it by entering your Social Security number and password below. Its a one-stop shop where employers and third-party administrators can manage all their business related to unemployment contributions including registering new businesses filing quarterly reports and making tax payments among. The SOURCE Upload File.

The Ohio Department of Job and Family Services Mike DeWine Governor Matt Damschroder ODJFS Director. Department of Labors Contacts for State UI Tax. The Department is not authorized to set up payment plans.

The SOURCE or the State of Ohio Unemployment Resource for Claimants and Employers is Ohios internet-based unemployment tax system. Report it by calling toll-free. This payment method charges your credit card Discover Visa MasterCard or American Express.

Pay via Guest Payment Service Register Pay via Online Services. As a result PUA claims are no longer being accepted. JFS should send you preprinted forms.

Welcome to Ohio Pandemic Unemployment Assistance. You may also use the Online Services portal to pay using a creditdebit card. You also can file a wage report online or adjust a filed wage report online.

You can file your reports and payments online or on paper. To file and pay online you can use either the ERIC system or the. Please allow 2-3 business days for.

Enter your email address and click the Save button. Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services. In accordance with Toledo Municipal Code 1905011 effective January 1 2021 the city of Toledo income tax rate will increase to two and one-half percent 25.

Beginning January 1 2018 employers are required to submit their quarterly reports electronically. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. Also you have the ability to view payments made within the past 61 months.

TurboTax Home Biz Windows. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. Using the online option reduces your tax return preparation time.

By appointment only. If you DID apply andor receive unemployment benefits from ODJFS. The two sections are considered a single report for filing purposes.

File Unemployment Taxes Online. If you have questions contact the Office of Unemployment Compensation Division of Tax and Employer Service at 614 466-2319. If you already have an email address on file with the Department follow these steps to validate your email address.

This includes extension and estimated payments original and amended return payments billing and assessment payments. Also used by employers to authorize the Ohio Department of Job and Family. To file on paper use Form JFS-20125 Quarterly Tax Return which contains both required sections.

Apply for Unemployment Now Employee 1099 Employee Employer. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov.

Log into Online Services with your username and password. Select a payment option. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes.

If you need to file an appeal. In addition The SOURCE allows employers and third-party administrators to manage all their business related to unemployment contributions online including registering new businesses. The SOURCE or the State of Ohio Unemployment Resource for Claimants and Employers is Ohios internet-based unemployment tax system.

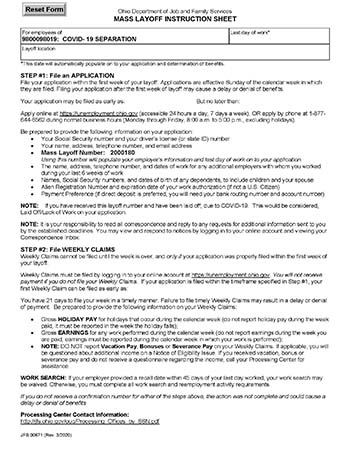

The federal Pandemic Unemployment Assistance PUA program ended on September 4 2021. Logon to Unemployment Tax Services. Unemployment Tax Payment Process.

Taxpayers should pay their income tax due by April 18 2022 to avoid late interest and penalties. Unemployment benefits are taxable pursuant to federal and Ohio law. JFS-20106 Employers Representative Authorization for Taxes.

I thought that unemployment benefits were not taxable by the state of Ohio. Payments made online may not immediately reflect on your Online Services dashboard. Allows you to electronically make Ohio individual income and school district income tax payments.

JFS-20106 Employers Representative Authorization for Taxes. Bank Account Online ACH Debit or Credit Card American Express Discover. Select the Payments tab from the My Home page.

They are included in the gross income number taken from the federal filing to start the state tax form. New Income Tax Rate. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information.

What are the consequences of failing to file or pay unemployment insurance taxes. When you enter wage information The SOURCE automatically calculates the taxable wages and contributions taxes due for you eliminating many common calculation errors. Please use the following steps in paying your unemployment taxes.

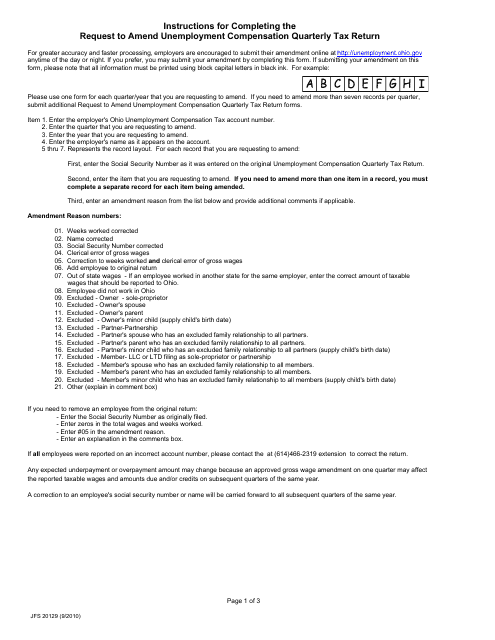

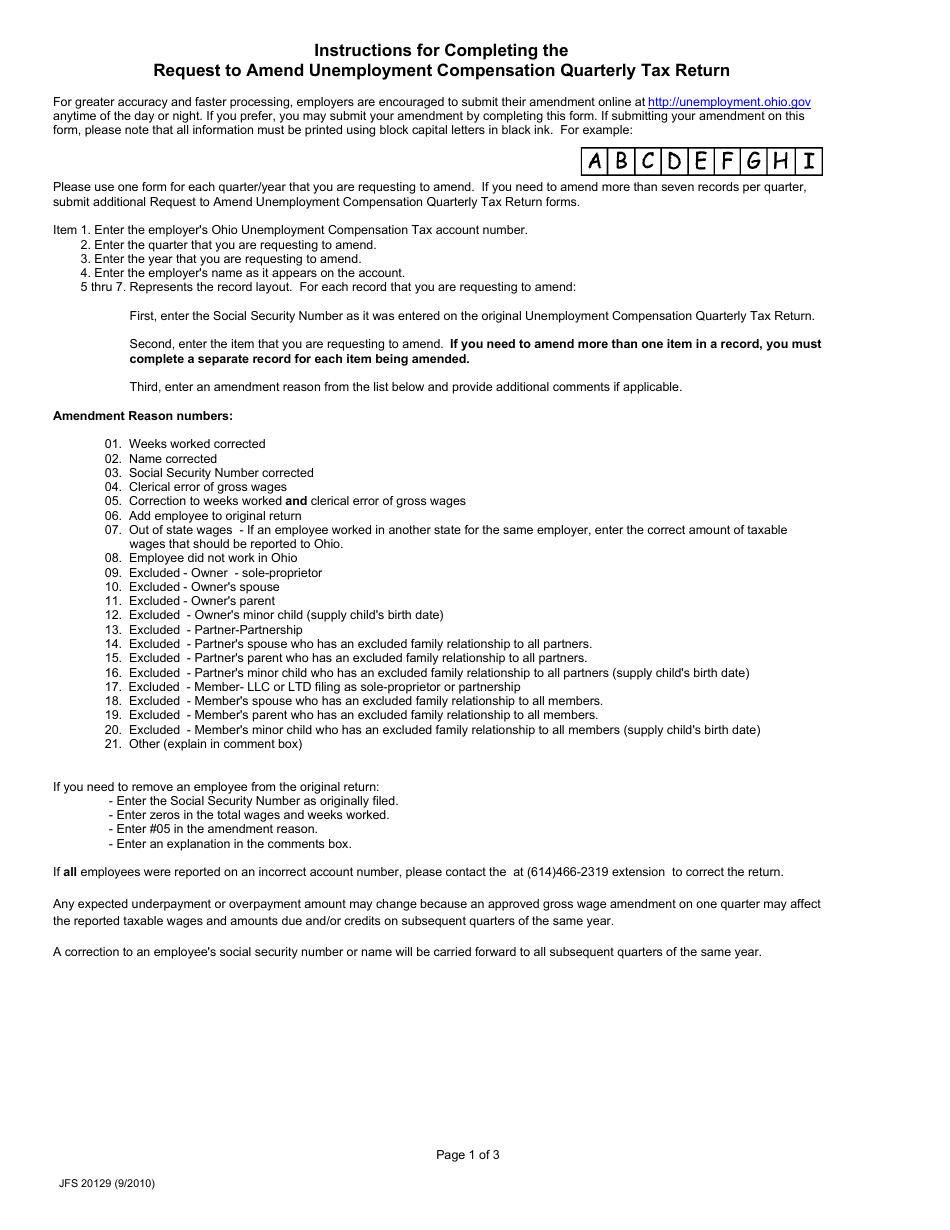

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Ohio Unemployment Login Problems Ohio Unemployment Ohio Gov

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Ohio Unemployment Phone Number Ohio Unemployment Customer Service Number Pua Ohio Unemployment Login

Ohio Doing More This Year To Warn Unemployment Fraud Victims Ahead Of Tax Season Cleveland Com

Some People Not Receiving Unemployment 1099 G Tax Forms

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

Ohio Unemployment Login Problems Ohio Unemployment Ohio Gov

How To Apply For Unemployment Benefits Online In Ohio Youtube