trust capital gains tax rate 2020

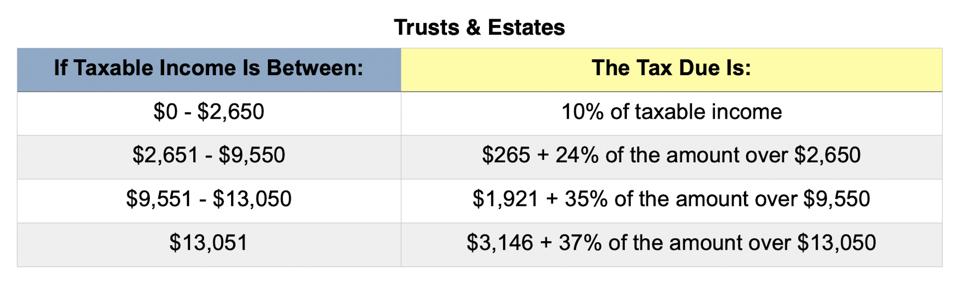

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. The 0 and 15 rates continue to apply to amounts below certain threshold amounts.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

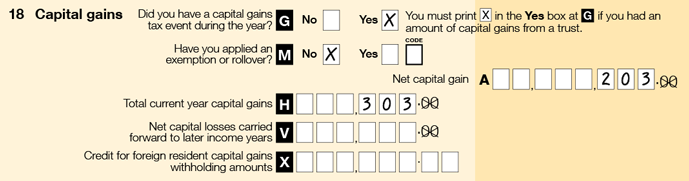

Trust tax rates are very high as you can see here.

. 10 percent of taxable income. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150.

The tax rate works out to be 3146 plus 37 of income over 13050. 8 Income tax is a tax that is imposed on people and. The standard rules apply to these four tax brackets.

Over 2600 but not over 9450. Events that trigger a disposal include a sale donation exchange loss death and emigration. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

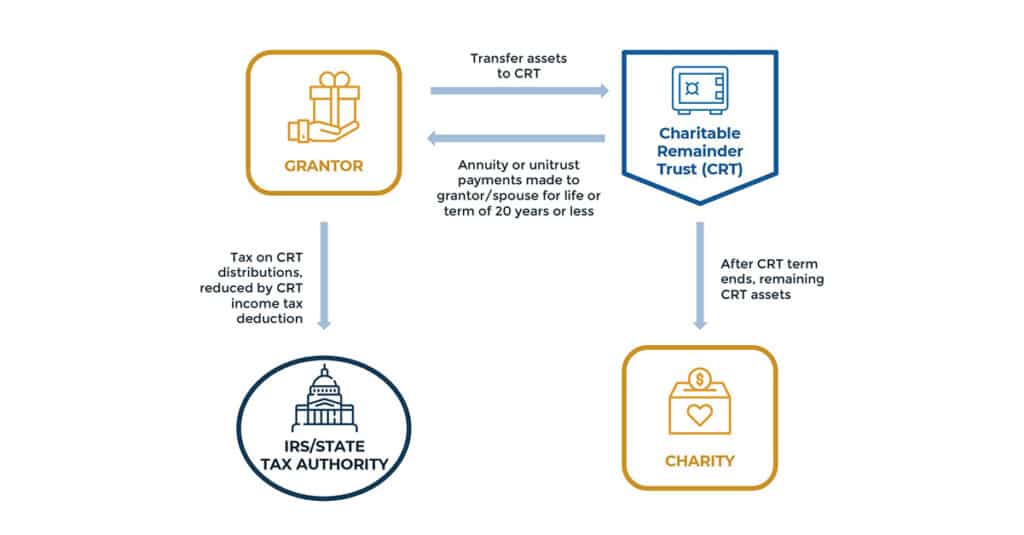

The trustee of an irrevocable trust has discretion to distribute income including capital gains. It continues to be important to obtain date of death values to support the step up in basis which will reduce the. The maximum tax rate for long-term capital gains and qualified dividends is 20.

For tax year 2020 the 20 rate applies to amounts above 13150. 260 plus 24 percent of the excess over 2600. 0 2650.

However note that Sec. Over 2600 but not over 9450. The following are some of the specific exclusions.

If taxable income is. California has nine tax brackets. Discover Helpful Information and Resources on Taxes From AARP.

1 2 4 6 8 93 103 113 and 123. Table of Current Income Tax Rates for Estates and Trusts 202 1. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate.

State taxes are in addition to the above. This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of 296 starting in tax year 2018 taxable income reduced to 80 times 37 top rate. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home.

Dividends non-qualified 60000. So for example if a trust earns 10000 in income during 2021 it would pay the following taxes. The tax rate works out to be 3146 plus 37 of income over 13050.

R2 million gain or loss on the disposal of a primary residence. 2022 Long-Term Capital Gains Trust Tax Rates. Long term capital gain 40000.

Capital gains and qualified dividends. Interest income 20000. Your 2021 Tax Bracket to See Whats Been Adjusted.

The 2020 rates and brackets for the income of an Estate or trust. If taxable income is. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000.

Where a trust is a special trust only 40 of the capital gain is included in the taxable income with an effective tax rate similar to that of an individual but discretionary family trusts do not qualify as special trusts. The highest trust and estate tax rate is 37. For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in 2020 the trust could potentially reduce its taxable income to zero for 2019 saving approximately 3150 in taxes the 2019 trust tax rate is 37 for income above 12750.

The tax rate schedule for estates and trusts in 2020 is as follows. Over 9450 but not over 12950. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150.

Capital gains is a tax paid on the profits made from the sale of an asset usually a property business stock or bond. Capital gains tax rates on most assets held for a year or less correspond to. 1904 plus 35 percent of the excess over 9450.

Qualified dividends are taxed as capital gain rather than as ordinary income. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. The trust has the following 2020 sources of income and deduction.

However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050. 4 rows The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets. State tax 2000 Trustee fees 4000 Legal fees 1000.

For trusts in 2022 there are three long-term capital. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

Most personal use assets. 10 percent of taxable income. An individual would have to make over 518500 in taxable income to be taxed at 37.

641 c 2 sets out the specific deductions available to ESBTs. 2020 Estate Gift GST and Trusts Estates Income Tax Rates. The 0 rate applies to amounts up to 2650.

IRS Form 1041 gives instructions on how to file. It applies to income of 13050 or more for deaths that occurred in 2021. Ad Compare Your 2022 Tax Bracket vs.

260 plus 24 percent of the excess over 2600. The trustees take the losses away from the gains leaving no. Where the capital gain is attributed to the trust the effective rate of tax on a capital gain is 36.

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Non Assessable Payments From A Trust Australian Taxation Office

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Charitable Remainder Trusts Crts Wealthspire

2021 Estate Income Tax Calculator Rates

Tax On Capital Gain On Sale Of Assets By Charitable Trust Ngo

Capital Gains Tax Commentary Gov Uk

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Florida Real Estate Taxes What You Need To Know

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gain Tax Calculator 2022 2021

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Distributable Net Income Tax Rules For Bypass Trusts

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World